What is CIBIL Score?

Loading your search...

A CIBIL score is a three-digit numeric summary that determines your creditworthiness. Ranging from 300 to 900, the CIBIL score is provided by the Credit Information Bureau (India) Ltd., a credit rating agency which is authorized by the Reserve Bank of India (RBI).

The role of a CIBIL score is crucial in the issuance of credit cards as well as the loan application process. The higher the score, the more likely it is that the Personal loan or Home loan and Credit Card will be considered and approved.

What is Full Form of CIBIL?

The full form of CIBIL is Credit Information Bureau (India) Limited (CIBIL). It is an RBI authorised credit bureau which manages and collects information about the credit history of a person, company or public and private establishments.

What is a Good CIBIL Score?

A good Credit score is between 720 and 900 and is solely based on your credit history and behaviour. This helps borrowers avail various benefits such as higher loan amounts, faster loan approvals, and lower interest rates. A CIBIL score of 750 and above is considered a good CIBIL score in the case of an unsecured loan. If you have a good CIBIL score, you can get the benefits such as.

- Quicker and faster loan application process

- Easier loan documentation process

- Lower interest rates on the loan

- A higher quantum of loan

- Longer or more flexible repayment tenure

- Choice between multiple lenders so that you can select the loan that's best for you In addition, such a score will lead to a quicker and easier documentation process. When it comes to a home loan, you can expect up to 80% of the total cost of the property if you have a CIBIL score between 700 and 900.

What is a CIBIL Report?

A CIBIL report, also known as a Credit Information Report (CIR) is a document listing all your borrowings and repayment histories. The CIBIL score or rating is derived out of this data as well as other variables that affect your financial position. CIBIL scores have become the benchmark for creditworthiness in India. The credit report is a report that includes your CIBIL credit score as well as other details on all your financial transactions related to credit. Your credit score is just a part of the report, which has a 3-digit number which will be anywhere in the range of 300 - 900.

The credit score is a depiction of your creditworthiness, while your report will include payment history, number of loans, your outstanding balances of any loans, the total of your credit limit, and loan details of all loans taken from a diverse pool of lenders. The credit report is more like a report card for your credit, and the CIBIL credit score is like the percentage you get on your report card. The higher your credit score is, the better it is for you. An average score of 750 is considered good for lenders to provide you with good deals and better rates of interest.

Importance of a Good CIBIL Score for Loans

A CIBIL score is considered good if it lies in the range of 700 and 900. This will be taken into account by banks and NBFCs when considering a loan application for most retail loans, whether it is a home loan or a vehicle loan.

A high CIBIL score, also called a credit score, has many benefits during the loan application process such as:

- Quicker and faster loan application process

- Easier loan documentation process

- Lower interest rates on the loan

- A higher quantum of loan

- Longer or more flexible repayment tenure

- Choose between multiple lenders so that you can select the loan that is the best for you. In addition, such a score will lead to a quicker and easier documentation process. When it comes to a home loan, you can expect up to 80% of the total cost of the property if you have a CIBIL score between 700 and 900.

How to Check CIBIL Score Online Step by Step?

Here is how you can check your CIBIL score:

- Go to the official CIBIL website

- Select 'Get Free CIBIL Score & Report’

- Type in your name, email ID, and password. Attach an ID proof (passport number, PAN card, Aadhaar or Voter ID). Then enter your PIN code, date of birth, and also your phone number

- Click on 'Accept and continue'

- You will receive an OTP on your mobile number. Type in the OTP and select 'Continue'

- Select 'Go to dashboard' and login and check your credit score

- You will be redirected to the website, myscore.cibil.com

- Click on 'Member Login' and once you log in, you can see your CIBIL score.

Pay and Check Your CIBIL Score Online:

CIBIL credit ratings can be checked online by following a few simple steps, as outlined below.

- Log on to the official CIBIL website and click on Know Your Score.

- Fill up the online form which asks for details such as name, date of birth, address, id proof, past loan history and other relevant data.

- On filling the form and accepting changes, you will be taken to the payments page. You can choose from multiple modes of payment such as prepaid cards, credit cards, net banking etc. A payment of Rs.550 has to be made to CIBIL to get your credit report.

- After successfully making the payment, you will be taken to an authentication page. Here, you will be required to answer 5 questions related to your credit history of which you will have to answer at least 3 questions correctly to authenticate your identity with CIBIL. Your report will be sent to your email address within the next 24 hours.

- If authentication fails, you can fill in and send a hard copy of the application to CIBIL by mail. You will subsequently also receive the report by mail.

Credit Score Range

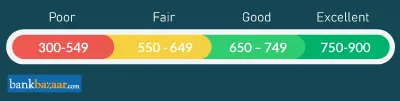

A CIBIL score ranges from 300 - 900, 900 being the highest. Generally, individuals with a CIBIL score of 750 and above are considered as responsible borrowers. Here are the different ranges of a CIBIL score.

NA/NH: If you have no credit history, your CIBIL score will be NA/NH which means it is either “not applicable" or no history". If you have not used a credit card or have never taken a loan, you will have no credit history. You might want to consider taking credit, as it will help you in building a credit history and get access to credit products.

350 - 549: A CIBIL score in this range is considered as a bad CIBIL score. It means you have been late in paying credit card bills or EMIs for loans. With a CIBIL score in this range, it will be difficult for you to get a loan or a credit card as you are at a high-risk of turning into a defaulter.

550 - 649: A CIBIL score in this range is considered as fair. However, only a handful of lenders would consider offering you credit as this is still not the best CIBIL score range.It suggests you have been struggling to pay the dues on time. The interest rates on the loan could also be higher. You need to take serious measures to improve your CIBIL score even further for better deals on loan.

650 - 749: If your CIBIL score is in this range, you are on the right path. You should continue displaying good credit behaviour and increase your score further. Lenders will consider your credit application and offer you a loan. However, you may still not have the negotiation power to get the best deal on the rate of interest for loan.

750 - 900: This is an excellent CIBIL score. It suggests you have been regular with credit payments and have an impressive payment history. Banks will offer you loans and credit cards as well considering you are at the lowest risk of turning into a defaulter.

Tips to Improve your CIBIL Score

It is important to have a high CIBIL score as it helps banks decide whether to extend a certain amount of credit to you or not. Here are some things that help in improving your CIBIL score:

- Pay your loan EMIs consistently on or before the due date.

- Ensure that you make credit card bill payments on or before the due date.

- Pay credit card bills in full every time without fail.

- Avoid over-leveraging.

- Maintain clean financial records without any outstanding debts and late payments.

- Have a good balance of secured as well as unsecured credit.

- Maintain a low credit utilisation ratio (20-30%) of the actual credit card limit.

- Make sure to check your credit score regularly.

- Review your credit report periodically and ensure there are no errors in the report.

- Do not depend on financial institutions and obtain copies of your credit reports.

- Maintaining discipline when it comes to credit card usage is of utmost importance. Make sure you are not exhausting your entire credit limit.

Factors that Affect your CIBIL Score

A CIBIL score is made up of four main factors. Each factor has a different weightage. Let’s take a look at the factors and how they can affect your CIBIL score.

Payment History | 30% |

Credit Exposure | 25% |

Credit Type and Duration | 25% |

Other Factors | 20% |

- Payment History:In order to maintain a high score, you need to be prompt with your monthly credit card bill payments as well as loan EMIs. If you are delaying your payments or are defaulting on EMIs, it will hamper your score. Irregular payment behaviour also suggests that you are struggling to manage your credit health. A recent CIBIL analysis (reported by the Financial Express) revealed that 30-day delinquency can reduce your score by 100 points.

- Credit Utilisation Ratio:Having a loan or multiple credit cards does not negatively impact your CIBIL score. However, if your credit utilisation ratio is high, it will bring your score down. Ideally, you should only spend up to 30% of your credit limit. A higher credit utilisation ratio suggests you have been increasing your debt and are likely to turn into a defaulter. Therefore, it is advised to keep a tab on your credit expenses and make sure you are not maxing out your limit.

- Type of Credit and Duration:The age of your credit history is the number of years that have passed since you opened your first credit account. CIBIL considers the average number of years for which you have been holding a credit account. Having a good balance of secured (car or home) loans as well as unsecured (credit card) loans helps to boost your score. When you have a healthy credit mix, it suggests that you have good experience in handling different types of accounts. A long credit history with good repayment behaviour makes you a low-risk borrower. It is better to start building your credit history at an early stage as it will be helpful later at the time when you’re planning to buy a house or a car.

- Other Factors:A credit inquiry is another factor that is considered while calculating your score. Every time you apply for a loan or a credit card, the lender will check your credit report. This is called a hard inquiry. If you make multiple credit requests within a short period, it will bring your score down. Therefore, it is advised to spread your credit applications throughout the year instead of making them all at once.

Building a CIBIL score is a slow process. You need to show consistent repayment behaviour and handle the available credit in a responsible manner to maintain a good score.

Factors that Don’t Affect your CIBIL score?

Your score is affected by many factors in addition to payment history and credit exposure, among others. However, there are some factors that will have no impact on your score. Here’s a list of them:

- Transactions related to your debit card:Any transactions made using your debit card will not affect your CIBIL score. CIBIL only tracks activities related to your credit card payments. Ensure you pay your credit card bills on time to maintain a healthy CIBIL score.

- Cheques that have bounced:Your CIBIL score will not be negatively impacted by a bounced check. When the business calculates your CIBIL score, these factors are not taken into account. Despite the fact that late and bounced payments are directly reported to CIBIL, your score is unaffected. Unless the bounced check is tied to a loan installment or repayment, they have absolutely little effect on your CIBIL score.

- Account Balance and Investment Schemes:CIBIL only checks your payment status related to any loan you may have availed and your credit card bills. If you have delayed the payment of EMIs and credit card bills, then your CIBIL score gets affected. The amount of cash you have in your savings account or investments made by you have no bearing whatsoever on your CIBIL score.

- Non-operative Savings Account:If you have any bank account which is not operative anymore or may have a negative balance, don’t worry about your CIBIL score getting affected because of it. The number of active savings accounts and negative balances are not tracked by CIBIL. Therefore, inactive accounts are not taken into account for calculating your CIBIL score. To better your financial situation, you should close all inactive accounts.

- Change in demographics:Your CIBIL score contains important data such as your name, occupation, city of residence, etc. However, if there is any change in any of such demographics, your CIBIL score will remain unaffected.

- Your spouse’s CIBIL score:Unless you are applying for a loan jointly, your spouse's CIBIL score will not have an impact on your own CIBIL score. Only your spouse's low CIBIL score affects your eligibility or likelihood of acceptance. If your spouse has a strong credit score, you should only apply for a loan jointly.

- Checking your CIBIL score repeatedly:One of the biggest misconceptions is that you check your CIBIL score repeatedly. Generally, you must check your CIBIL score during January or July since that is when your score gets updated. However, if any financial entity raises a hard inquiry asking the CIBIL to show them your CIBIL score, then your numbers drop. You must check your CIBIL score on a regular basis and ensure you take measures to improve your score if they have dropped.

- Non-payment of utility bills:Your CIBILTM score won't be impacted by utility expenses like house taxes, energy bills, or cell phone bills. However, since not paying your debts on time is generally bad, it might affect other aspects of your life.

- Change in your income:Your CIBIL score is unaffected by the change in income. Some individuals believe that CIBIL keeps track of your income and expenses. However, CIBIL is unconcerned about this. It just cares about the state of your credit. Your ability to spend money will change as your income changes. You must budget your spending based on your income. If you have credit card bills, or loan EMIs, this could have an impact on your ability to pay them back.

Benefits of Good CIBIL Score

A good CIBIL score is necessary and carries numerous advantages. That’s why an aspiring loan applicant must be informed of the benefits, before applying for a loan. The benefits of a good CIBIL score are mentioned below:

- Lower interest rate: Lower interest rates are the main benefit of having a good CIBIL score. The rate of interest is determined by the likelihood of default. A good credit score gives your lender assurance that you will repay the loan regularly and timely. Hence, the risk of default is low which allows your lender to offer you a lower interest rate.

- Higher chances of approval: When you apply for a loan, any lender will pull your credit report and run a credit check. If you have an excellent credit score, your chances of getting a loan approved are exceptionally high due to your solid credit history and previous instances of regular and timely loan repayments. A good CIBIL score also shows that you haven't taken out many loans from different lenders, or that you haven't accumulated debt that makes it difficult to repay the loan. As a result, the lender is confident that the loan will be repaid by you in full and on time, and so the odds of approval are quite high and nearly guaranteed.

- High Credit Limit: A good CIBIL score indicates that you are a reliable and responsible borrower. As a result, the lender may not be afraid to extend you a bigger credit limit on your card or a higher loan amount.

CIBIL Credit Report Checklist

CIBIL credit reports are important for many reasons. Follow the checklist given below is what you should keep in mind while checking your credit score

- History of repayments - Your history of loan and credit card repayment is detailed in this section. It also includes information on the months that the repayments were paid and if they were completed before the due date. Additionally, it lists any missed or late payments. Banks and lenders use the details in this section to evaluate your credit repayment behaviour. You must thus carefully review and make sure that the repayment history is fully described and updated to reflect the most recent information in your credit report.

- Credit Accounts - The part on credit accounts in a credit report covers all credit accounts, both open and cancelled recently. These details are carefully examined by banks and lenders when they assess your creditworthiness. Therefore, it's crucial to check that the information on your loans and credit card accounts is accurate and up to date in your credit report. Any erroneous information or inaccuracy can seriously affect your credit score and your ability to qualify for a loan or credit card.

- Credit utilization ratio (CUR) - This is one of the most crucial factors credit bureaus take into account when determining your credit score. The credit utilisation ratio shows how much of your available credit you have really used. Banks favour lending to borrowers with credit utilisation ratios under 30%. Those who frequently go above this limit might ask their credit card company to raise it, or they can apply for a new credit card. As long as you do not raise your credit card usage, this aids in lowering your credit utilisation ratio.

- Personal details - Your name, PAN, mobile number, email address, and other personal data are covered in this section. Any inaccurate or missing information in your credit report compared to what is stated in your credit application can increase or hurt your chances of simply obtaining a loan or credit card, as lenders look at your credit report when analysing a loan or credit card application.

- Credit report enquiries - Any credit report inquiries that a lender initiates are covered by this clause. Depending on the credit bureau, this section typically includes the lender's name, the application date, the type of credit requested, and other information. Banks and lenders review your credit report, which is produced by the credit bureaus, each time you apply for a loan or credit card. These inquiries are known as "hard inquiries" since they are started by the lender and each one appears in your credit report. Your credit score may suffer as a result and drop a few points. Therefore, applying for many loans or credit cards within a short period of time with various lenders or credit card issuers might cause a big drop in your credit score.

How is CIBIL Score Calculated?

A CIBIL Score is a numeric summary of credit history that is calculated based on the following factors:

Track Record of Past Payments |

|

Previous Settlements, Defaults, Write-offs |

|

Loans as Proportion of Income |

|

Secured Loans vs. Unsecured Loans and credit cards |

|

Loan Equities |

|

Credit Bureaus in India

A credit bureau is a company that gathers and analyses information about a person's or a company's credit transactions. These include the borrowing of loans, the use of credit cards, the use of overdrafts, etc., and their repayments. Additionally, information on Income Taxes, timely utility bill payment, and other matters may be included in this analysis. Lending institutions, data collection companies, money collection agencies, and other organisations provide such information. The four credit bureaus in India are listed below:

TransUnion Credit Information Bureau (India) Limited:

- The most well-known credit agency in India is TransUnion Credit Information agency (India) Limited, also referred to as CIBIL.

- It was founded in 2000 and currently manages the credit histories of over 600 million Indians and 32 million corporate entities.

- The credit bureau offers comprehensive reports on the basis of credit statements from personal as well as commercial borrowers to its reputable partners.

Experian:

- Experian, another credit bureau recognized by the Securities and Exchange Board of India (SEBI), was founded in 2006 and began operating in India in 2010.

- Individuals can obtain credit information reports which outline their credit history.

- Customer acquisition records, customer targeting and engagement reports, and other data can be accessed by companies and businesses.

CRIF High Mark:

- CRIF High Mark is the only credit bureau authorized to conduct business in India by the Reserve Bank of India.

- It was founded in 2007 and received its operating license in 2010.

- It pertains to people, microfinance borrowers, medium and small enterprises (MSMEs), etc.

- The range of scores provided by CRIF High Mark is 300 to 850, with a score of 720 or higher being the best and a score of 640 or less being subpar.

Equifax:

- Equifax, which is one of the three biggest credit bureaus in the world, started out as a retail credit business in 1899.

- It received its operating license in 2010 and provides credit scores, portfolio scores, risk scores, and others for people.

- These scores range in value from 1 to 999, with 999 representing the highest score.

Why is Your Credit Score Low?

The primary reasons for a low credit score are listed below:

- Many people are unaware that even one or two missed credit card payments can negatively impact your credit score. The more delayed payments you have, the more damage is done to your credit history and credit score.

- In case you have not availed a loan, you may not have much of a credit history and this might result in a low credit score.

- You might occasionally not be able to make your payments because of an unexpected emergency. Any missed payments will be noted on your credit history, which will lower your score.

- Sometimes an administrative mistake can lead to inaccurate information being reported on your credit report. This might occasionally occur due to fraud. Such errors may result in a lower credit score without any of your fault, alerting potential lenders regarding your poor credit.

How to Get a CIBIL Credit Score and Report?

To obtain your credit score and credit report you will need to contact the credit rating agency in India, CIBIL. They will be charges involved to obtain a credit score and credit report. Any individual wanting this report will need to pay an amount of maximum Rs. 500 to obtain this report, the application process with a payment applies to both individuals and institutions. Let’s say a bank or financial institution needs your credit report with your score to check your loan eligibility, even if they will need to make a payment for that copy. There are a few websites that will promise to give you your credit report and score for free, but will ask you to sign up with them or become a member of their website etc.

How to Check Your Rank in CIBIL?

With the launch of CIBIL Score 2.0, banks will now be able to gauge the creditworthiness and risk of new borrowers. This system provides ranks to customers who have a credit history of less than six months. The risk index is from 1 to 5, with 1 being the highest on the index and 5 being the lowest.

Banks in India can check this database to assess and evaluate a potential borrower and whether the loan should be approved or not.

Here’s how you know where you rank on the new scoring version.

If your rank is ‘NA’ or ‘NH’:

- You have no credit history, which means CIBIL has no database dedicated to your financial records.

- Your credit report only consists of enquiries. This means, potential lenders have checked your report but haven’t approved any loan.

- No lender or financial institution has reported any information to CIBIL in the last 24 months.

If your rank is between 1 and 5:

- Your credit history is relatively new and hasn’t been in the system for more than 6 months.

- If your score is closer to one, you’re viewed as a risky borrower.

- If your score is closer to 5, you’re viewed as a responsible borrower.

To get approved for loans, you will have to maintain a good credit history and a clean financial record. Even though your history is less than six months old, there are certain steps you can take to improve your score and thus, your creditworthiness.

How Often are CIBIL Reports Updated?

Lenders will submit all your financial information every 30 to 45 days to CIBIL. This will include your payments, your outstanding balances, delayed payments, and more. If you have borrowed finances from a smaller lender, they might share your information on a quarterly basis.

Once CIBIL receives this data, they will process it so it reflects on your credit report. Now, if you choose to buy your CIBIL report within 45 days of paying your last dues, you may not receive the updated version. Your report may show incorrect current balances or amounts due.

What you should do is look for the ‘Date Reported’ section in your report. If the information submitted by your lender is older than two months, and the payment details are still not displayed correctly, you should raise a dispute for the same.

It’s advised to wait for at least 45 days before you look for your newest report or raise a dispute. Each lender may share their data in their own time. So, even if you clear all your dues for a certain period, these details will not show up on your credit report immediately.

Now let’s say you have the latest report in hand, but the data is inaccurate. So, you decide to raise a dispute with your lender. For example, you made your credit card payment, but it hasn’t reflected in your report. When you’ve resolved this issue, your lender should ideally share the updated data with CIBIL. If they haven’t, there will not be any change in your report or score. You will then have to contact your lender to submit the details to CIBIL. This is because CIBIL cannot change your report unless your lender reports it. Keep in mind though, if the dispute has been resolved in your favour, it will take up to 90 days to reflect in your credit report.

It’s important to thoroughly check your CIBIL report and raise disputes if you find any discrepancies.

Difference Between CIBIL Score and Credit Score:

The differences between CIBIL Score and Credit Score are given below:

One of the four main credit bureaus in India, CIBIL is associated with numerous major banks, Non-Banking Financial Companies (NBFCs), and housing finance companies. Experian, Equifax, and CRIF Highmark are the other three prominent bureaus. The Reserve Bank of India has granted licenses to each of these credit agencies. The CIBIL score refers to the credit rating determined by CIBIL.

Your creditworthiness as a potential borrower is indicated by your credit rating. Your credit history, including the total amount due, credit card bills, repayment history, the number of credit accounts you have, and the credit utilisation information are taken into account when calculating your credit score.

Does Checking Your CIBIL Credit Score Frequently Impact It

Many individuals think that checking their CIBIL credit scores or requesting a copy of their credit reports may have a negative effect on their credit scores. However, checking your own credit reports or credit scores has no effect on your CIBIL credit scores. In reality, checking your credit reports and credit scores from time to time is an important method of making sure your personal and account information is accurate. This might assist in identifying signs of potentially fraudulent activity.

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

FAQs on CIBIL Score

- Will opting for a credit card decrease my CIBIL score?

No, opting for a credit card will not decrease your credit score.

- For how long does CIBIL keep the record of the defaulters?

CIBIL is not required to publish the record of the defaulters, however, the CIBIL CIR contains the details of the defaults of a particular individual. The details of such defaults are on record for a maximum of seven years.

- Is it possible for the CIBIL Score to change?

The CIBIL Score will change based on the various factors such as any change in loan/credit account, credit repayment history, missed payments, etc. The score can also change when your lender carries out a hard check on your credit report.

- Is there any other credit bureau apart from CIBIL that provides credit score/report in India?

The three credit bureaus in India apart from CIBIL or TransUnion Credit Information Bureau (India) Limited), are CRIF High Mark, Experian, and Equifax.

- What is Credit Information Report (CIR) and how it different from CIBIL Score?

A Credit Information Report (CIR) is the complete summary of your credit history based on the last 5-7 years of credit and loan accounts. The CIBIL Score is a part of the CIR. The score is an indication of your credit/financial health that is calculated based on the various factors that prepare the CIR.

- Who can access your CIBIL Score?

Your CIIBL Score can only be accessed by CIBIL Members such as certain banks, your lender, you, and other authorized establishments.

- How can I check my CIBIL Report?

You can request your CIBIL report by visiting the cibil website. You will need to enter personal details such as name, PAN card number, date of birth, gender, etc., clear the personal verification process, and make a fee payment in order to access your credit report.

- How does CIBIL get the information of your credit/loan history?

The CIBIL Members such as banks and other government agencies provide financial information of an individual on a monthly basis to CIBIL in exchange for access to the credit reports and scores prepared by CIBIL.

- Why do the lenders need to check the CIBIL Score?

While reviewing loan/credit applications, it becomes essential for the banks to consider the repayment capability of an individual. The credit score and report help the lenders determine the repayment capabilities of an individual.

- What kind of credit/loan account details are included in the credit report?

The credit report will show the total credit/loan amount, EMI details, missed/late payment, lender’s name, and other related information.

- Is it possible for CIBIL to delete or amend my credit information independently?

CIBIL is not allowed to delete or make any changes to the Credit Information Report (CIR) independently.

- What is CIBIL 2.0?

CIBIL 2.0 is a new scoring model that TransUnion CIBIL Limited uses to calculate the credit report for individuals. Individuals with a new credit history of 6 months or less are assigned a score based on the risk factors involved in lending to new borrowers.

- Will there be any impact if I check my credit score frequently?

No. When you request your own credit score/report, it will be considered a soft check that doesn't have any impact on the credit score.

- What is a control number?

The control number is a nine-digit unique number that helps CIBIL track your credit report. The control number is generated if and when banks access your credit report.

- How do you correct errors in your CIBIL report?

RBI has made it mandatory for banks to comply with an individual's desire to access his or her credit report. If a bank declines a credit card or loan application, you can ask for the control number of your credit report. You can then contact CIBIL at info@cibil.com and communicate details of errors in the report.

- How do a greater number of personal (unsecured) loans affect your score?

A greater number of personal (unsecured) loans would also affect the score in a negative way since such loans have a high rate of interest compared to car or home loans and, therefore, are more likely to result in defaults.

- Do late payments and high utilization of credit limits have a negative effect on your score?

If you have missed payments on any of your loans over the years, your CIBIL score would be negatively affected. A higher utilization pattern equals to more repayments and, therefore, negatively affects your score.

- Will opting for a credit card decrease my score?

If you have a zero outstanding balance on your old credit card, there is no reason to unduly worry about it and close it. If you have a credit card with a clear payment history, it will not only reflect your responsible credit behaviour but also keep your utilization rate low, which impacts your score positively.

- Can a person achieve a perfect CIBIL score?

It's crucial to remember that while a higher CIBIL score implies better creditworthiness, getting a perfect score of 900 is uncommon. A score above 750 is regarded by lenders as good, and borrowers with such scores typically qualify for favourable loan terms.

- How quickly can a CIBIL score be raised?

The length of time it takes to raise a CIBIL score varies depending on a number of variables, including the severity of the credit concerns and your attempts to resolve them. To see a discernible increase in your score, it typically takes several months to a year or more of prudent credit behaviour.

- What is a CIBIL score of zero?

A CIBIL score of zero or one indicates that there is no credit history information available for the borrower or that there is no credit history information available for the borrower. The CIBIL score of '0' is equivalent to the letter 'NA'.

- Can I buy CIBIL score?

Yes, you can visit the CIBIL’s official website where upon the payment of Rs.550 you can purchase your CIBIL score, the access to which you will have within 3 business days.

- Do lenders make credit decisions based solely on the CIBIL score?

While the CIBIL score is significant, lenders also take other variables into account when deciding whether to grant credit, including income, employment history, previous debts, and other criteria. One of the important factors they take into consideration, but not the only one, is the CIBIL score.

News on Cibil Credit Score

RBI Announces New CIBIL Rules for 2025

The RBI (Reserve Bank of India) has introduced new rules for CIBIL scoring and credit reporting, effective from 1 December 2025. The updated CIBIL rules aim to improve the transparency and accuracy of credit information.

The major changes include a uniform credit reporting format to reduce inconsistencies, an enhanced borrower consent protocol, quick dispute resolution within 30 days, and a monthly mandatory update on loan status. It has also been made compulsory for lenders to report sanctioned limits accurately to eliminate inflated or understated credit history that can affect the scores.

The new CIBIL rules are expected to enhance transparency in credit reporting and reduce fraudulent reporting. The updates apply to banks, NBFCs (Non-Banking Financial Companies), RBI-recognised credit bureaus, and borrowers, including businesses and individuals with loans, credit cards, and other forms of credit.

Alternative Credit Checks to Replace Mandatory CIBIL Score for Loan Approvals

The Ministry of Finance claims that there is no minimum CIBIL score needed for bank loans to first-time borrowers. Before offering a potential borrower any kind of credit facility, lenders should assess a number of variables, including the information in the Credit Data Report.

Although first-time borrowers may not need a CIBIL score, the finance ministry has asked banks to do background checks and due diligence on applicants. These inspections would look at things like credit history, past repayment history, late repayments, loans that have been paid off, restructured, or canceled, etc. According to the minister, credit information companies are allowed to charge up to Rs. 100 for a copy of a person's credit record. This is the maximum amount that will be accepted.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.