How Long It takes To Improve Credit Score?

Loading your search...

A credit score is a key indicator for lenders to determine your loan repaying ability. Learn about the different ways you can improve your credit score.

People with a poor credit or CIBIL score may only get an approval for a credit card or any other financial products that require good credit score when the credit score improves to a satisfactory level for banks. In such a case, enhancing the credit score becomes vital and yet it cannot be done in haste.

It takes a minimum of 12 to 18 months to enhance one’s credit score and get to a number that gives confidence to the financial institution you are about to apply for a loan or a new credit card. Also, it is important to note that the quantum of damage on your credit score also acts as a factor for how long it will take to improve your credit score. Often banks and financial companies have a different CIBIL score bracket for various products.

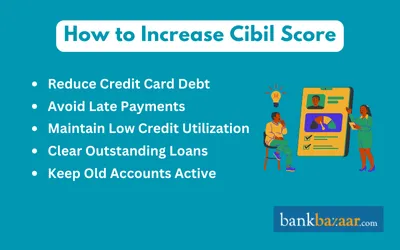

Tips to efficiently Enhance Credit Score

Here are some things an individual can do for damage control on credit score:

- It goes without saying that one needs to pay their due bills before the due date. But this also means that you need to pay your credit card and other payments before time and not just a day before. This is of course if you want to enhance your credit score.

- If you have loans standing with high interest rates then clear them early or to reduce your interest rate, else high interest rates will further affect your CIBIL score. It is always a good idea to opt for secured and unsecured loans hence.

- Use the plastic card but a different one, the debit kind. It is essential to start knowing how much money you can actually spend and debit cards help you to enhance your CIBIL score and avoid credit debt at the same time. Use our debit cards at least for a few years, unless absolutely necessary to use your credit card.

- When you enquire about other credit cards, it affects your credit score for the worse. Hence, avoid it as much as possible. If you really want to research about a credit card, it is best to do it online where you can surf all about a particular credit card as much as you want without actually communicating directly with the credit card company.

- Balance and prioritizing things that you need to purchase and want to purchase. Keep to the list that you need to purchase and reduce the number things in it as much a possible.

- Make sure that your never reach your credit limit and instead keep a buffer limit. It is best if you are able to save some money in your account to show higher savings over time, for improving your credit score.

- Do not borrow more to pay for loans and bills unless absolutely necessary.

Nobody can hence accurately predict the time required to enhance an individual’s credit score. Credit improvement is however not too difficult if the effort is consistent over a long period of time. The main deal with improving credit score is taking care of the factors that affect your credit score.

What is a Good Credit Score Range?

Generally, a credit score of 750 and above is considered as ideal by the majority of banks and non- banking finance companies. A healthy credit score indicates that you can be trusted with credit. However, different credit bureaus have different ranges. Let?s take a look at different credit score ranges.

- NA/NH:If you have no credit history or you do not have enough credit history to be scored. This indicates that you are a new to the credit rating system.

- 300-500:If you have a credit score in this range, it suggests that you have not been responsible with your repayments and have several debt. It also means you have not maintained a high credit utilization ratio for a long time. Such customers with indicate a high risk of default and lenders will be wary of extending credit.

- 500-650:If you have a credit score in this range, it indicates that you have defaulted payment for a good number of times. Therefore, you will fall in the risk bracket to turn a defaulter as well.

- 650-750:A credit score in this range indicates that you have a record of consistent repayment history and a better understanding of handling credit. This also suggests that you have a sound financial health and are less likely to default credit.

- 750-850:With this credit score this high, lenders will know that you are at a very low risk of turning a defaulter. It also suggests that you have consistently displayed an excellent repayment behaviour and maintained a low credit utilisation ratio.

- 850:With a credit score of 850 and above, it suggests you have been on top of your game in terms of handling the credit and having mixed type of credit. A high credit score of 850 will put you in a position to receive the best deals related to credit cards and loans.

How to Improve Your Credit Score?

- Low credit utilisation ratio: Maintain a discipline when it comes to credit card usage. Make sure you are not exhausting your whole credit limit. Ideally, you should spend only 20%-30% of your credit limit. Until your credit score reaches above 750, it is advised to not spend over 50% of your credit card limit.

- Check and monitor your credit score: It is better to check your credit score regularly. This will help you rectify if there are any incorrect or false records about your credit account.

- Make payments on time: In order to prove that you can manage your debt efficiently, make sure make credit payments on time. Avoid delays in paying your bills to maintain a good credit.

- Review your credit report: In addition to the credit score, you should check your credit report from time-to-time as it might have errors.

- Increase your credit limit: Request your credit card issuer to increase your credit limit. A credit limit is the total amount you can borrow through the card.

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

CIBIL Related Articles

- Factors that affect CIBIL Score

- Top CIBIL Improvement Factors

- How to Increase CIBIL Score

- Know the factors that affect CIBIL Score

- Good habits can make good CIBIL

- Tips for good CIBIL Score

- CIBIL

- CIBIL Myths

- Resolve CIBIL Errors

- How Credit Information is important

Know More About CIBIL

TransUnion CIBIL is one of the leading credit information companies in India. The company maintains one of the largest collections of consumer credit information in the world. CIBIL Score plays a key role in the lives of consumers. Banks and other lenders check the CIBIL Score of the applicants before approving their loan or credit card application. Consumers can visit the official website of CIBIL to check their CIBIL Score and Report.

FAQs on How Long It takes To Improve Credit Score

- Why is it important to have a high credit score?

A credit score is calculated based on various factors like timely repayment of loans, credit utilisation, length of the credit history, etc. A higher credit score shows a person's creditworthiness and improves his chances of getting a loan approved.

- Does the credit score get affected negatively if I apply for multiple credit cards?

Yes, the credit score decreases if you apply for multiple credit cards in a short span of time. This is because, each time you apply for a credit card, the card issuer company requests your credit report from the credit bureau. This gets registered as a hard enquiry which negatively affects the credit report.

- How can I use my credit card to boost my credit score?

A credit card can act as an effective tool to boost credit scores if used wisely. You need to keep your credit utilisation ratio within 30%, repay outstanding dues on time, and avoid applying for multiple credit cards in a short period. These simple steps will surely help you raise your credit score in the long run.

- What is the impact of late payment on the credit score?

The late payment history reflects on the credit report for up to seven years and decreases the credit score. To minimize its negative effect on the credit score, make sure that you do timely repayment of the outstanding dues.

- Which companies provide credit reports in India?

There are four companies that provide credit reports in India - TransUnion CIBIL, Experian, Equifax, and CRIF Highmark.

- Is there any difference between CIBIL score and credit score?

A credit score is a measure that banks look at to calculate a person's creditworthiness, while TransUnion CIBIL is one of the four companies that provide credit reports in India. A CIBIL score is the credit score calculated using the credit history as per the CIBIL report.

- Do credit scores vary across credit bureaus?

Yes, credit scores do differ across credit bureaus. This is because each credit bureau has a different algorithm for calculating the credit scores. The underlying principles for credit score calculation is same for all bureaus. However, the variables considered for evaluating the scores vary from one credit bureau to another.

- Does closing an old credit card boost your credit score?

No, the credit bureaus count the closing of an old credit card as a negative move. It is advisable to keep your card active with minimum transactions even if you are not using it.

- Do debit card transactions help boost credit scores?

No, as debit cards do not contribute to creating a credit history, the debit card transactions are not counted for calculating the credit score.

- Do the lender and customer have access to the same credit report?

You, as a customer will receive a summarized credit report mentioning only the required point. It does not matter if the report is paid or free. However, the lender will have access to a much more detailed report.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.